Flood Risk & Insurance Costs

Who Needs Flood Insurance?

If you're buying a home in a flood zone and plan on using a loan to purchase the property, the lender may require you get flood insurance if the flood risk is high enough. To get flood insurance your community has to be participating in the Nation Flood Insurance Program. Here is a list of those communities. The best way to know risk, costs and if you're in a participating community is to call an insurance agent. Otherwise, you can use Floodsmart.gov to get a good idea of what to expect.

Is The Home In A Flood Zone & How Much Will It Cost?

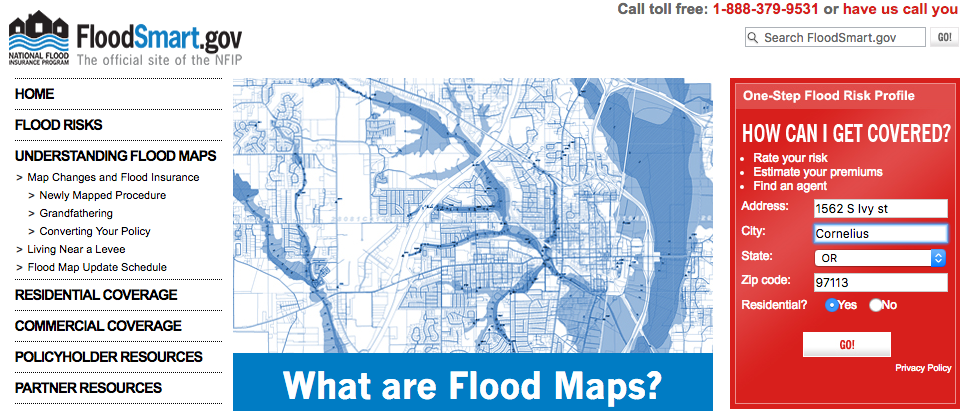

- Go to https://www.floodsmart.gov/floodsmart/

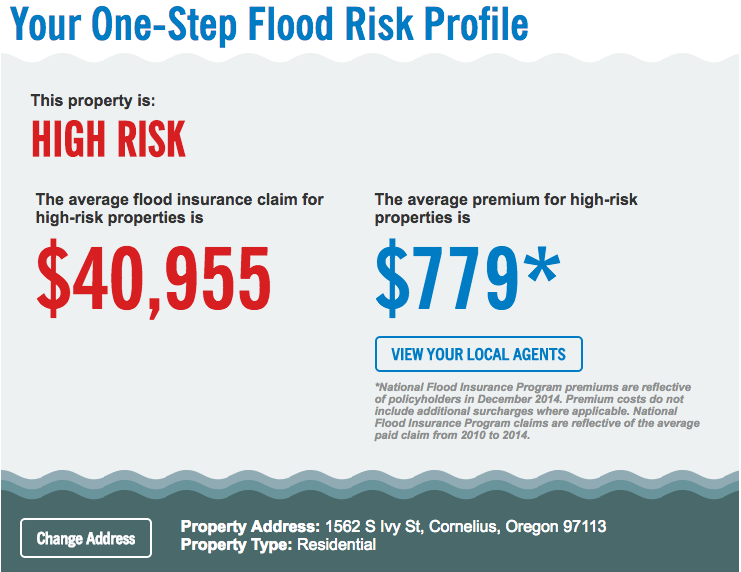

- Type in the address of the home in question in the red box on the right side of the screen and click "GO!." You can also use the address seen in the example below to see an example of a high flood hazard home.

Important Note:

- The risk profile displayed at FloodSmart.gov is not a legal document. Risk profiles are meant to be used as advisory tools for general flood hazard awareness and education. Do not use this information to make final decisions about purchasing property or flood insurance.

- To determine your actual flood risk, please contact your insurance agent. You can also visit the FEMA Map Information Center to view the latest flood map for your community.

- Please note that the results of this profile are not limited to National Flood Insurance Program (NFIP) communities. However, flood insurance is only made available to these participating communities. To find out if your community is a part of the NFIP, please refer to the Community Status Book or contact your insurance agent.